Rino Mastrotto Rino Mastrotto will save 7.5 million liters of water this year

Thanks to the adoption of the innovative “Hearth” tanning process, the tanning group reduces water consumption by 91%

Keep reading...

The Dutch chemical group has been valued at €2.1 billion

February 2026

On February 4, Henkel announced that it had reached an agreement to acquire the Dutch group Stahl for €2.1 billion. The chemical company employs approximately 1,700 people and reported sales of approximately €725 million in fiscal year 2025.

Majority-owned by French private equity firm Wendel SE (minority shareholders include BASF and Clariant, which together hold 30% of the shares), Stahl is a leader in the field of high-performance specialty coatings for flexible materials, providing solutions to leading brands in the automotive, fashion & lifestyle, and packaging sectors worldwide. The portfolio includes coatings for leather finishing, high-performance coatings for paper packaging, and graphic applications.

“With the acquisition of Stahl,” said Carsten Knobel, CEO of Henkel, “we will further strengthen our Adhesive Technologies business unit in line with our strategic agenda. This transaction will enable us to expand in the specialty coatings category, with a product offering for our core markets and new application segments.”

For its part, Stahl aims to further strengthen its focus on the high-performance specialty coatings segment. As for activities related to the tanning sector, it should be noted that Stahl’s wet end division had already been spun off from the group with the creation at the end of 2025 of MUNO, a new independent company based in Milan that presents itself as a global supplier specializing in solutions for the wet end of tanning and is led by CEO Xavier Rafols.

Thanks to the adoption of the innovative “Hearth” tanning process, the tanning group reduces water consumption by 91%

Keep reading...

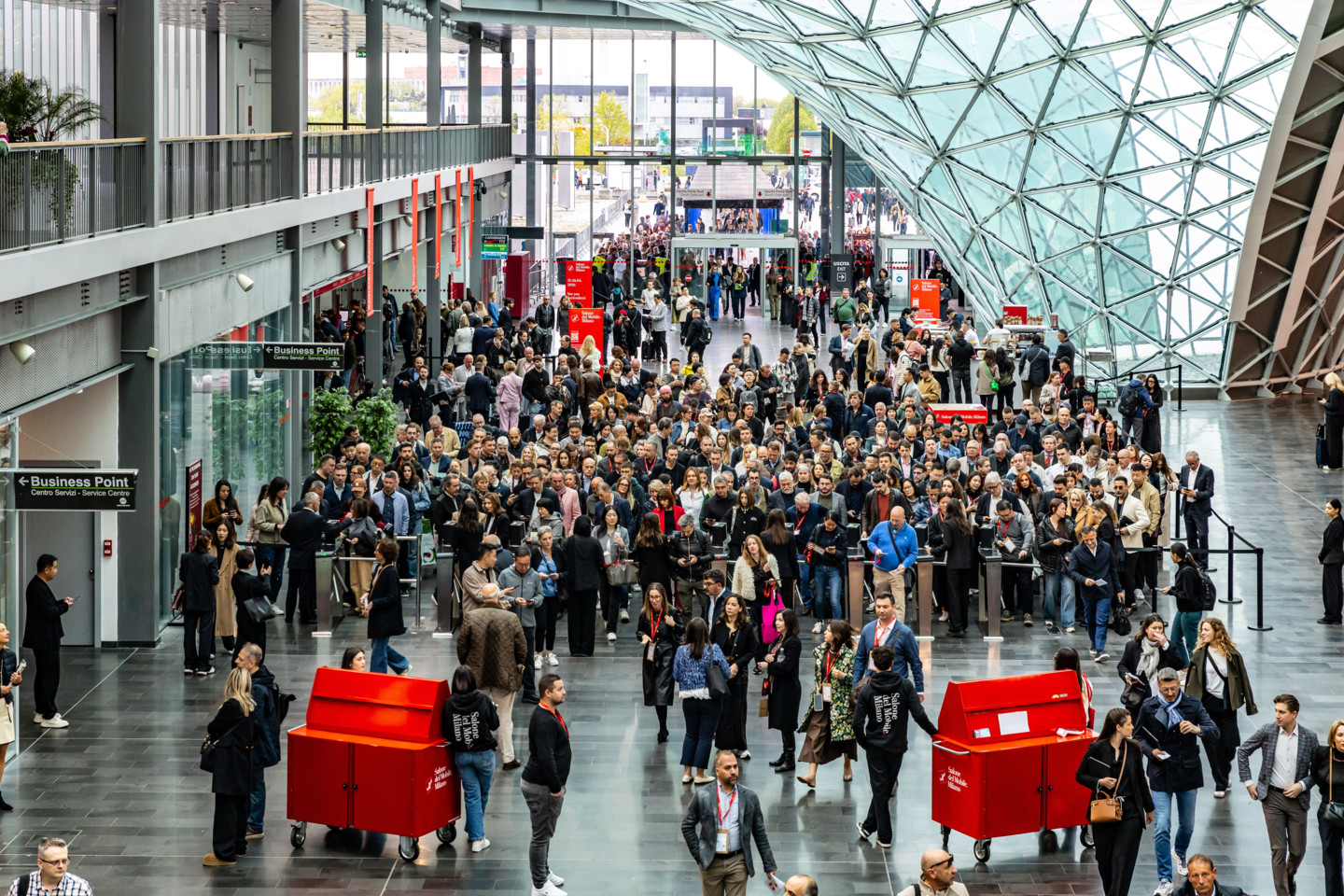

Everything is ready for the big event scheduled from April 21 to 26 with 1,900 exhibitors. Despite the critical issues, the Italian wood-furniture supply chain closed 2025 on a positive note (+1.3%)

Keep reading...

The highlight of the offering presented at the Chennai trade fair will be the “local for local” range of synthetic tannins with extremely low bisphenol content.

Keep reading...You must login to read this free content

This content requires a subscription to view. Are you already a subscriber? Sign in