TFL highlights sustainable leather solutions at IILF 2026

The highlight of the offering presented at the Chennai trade fair will be the “local for local” range of synthetic tannins with extremely low bisphenol content.

Keep reading...

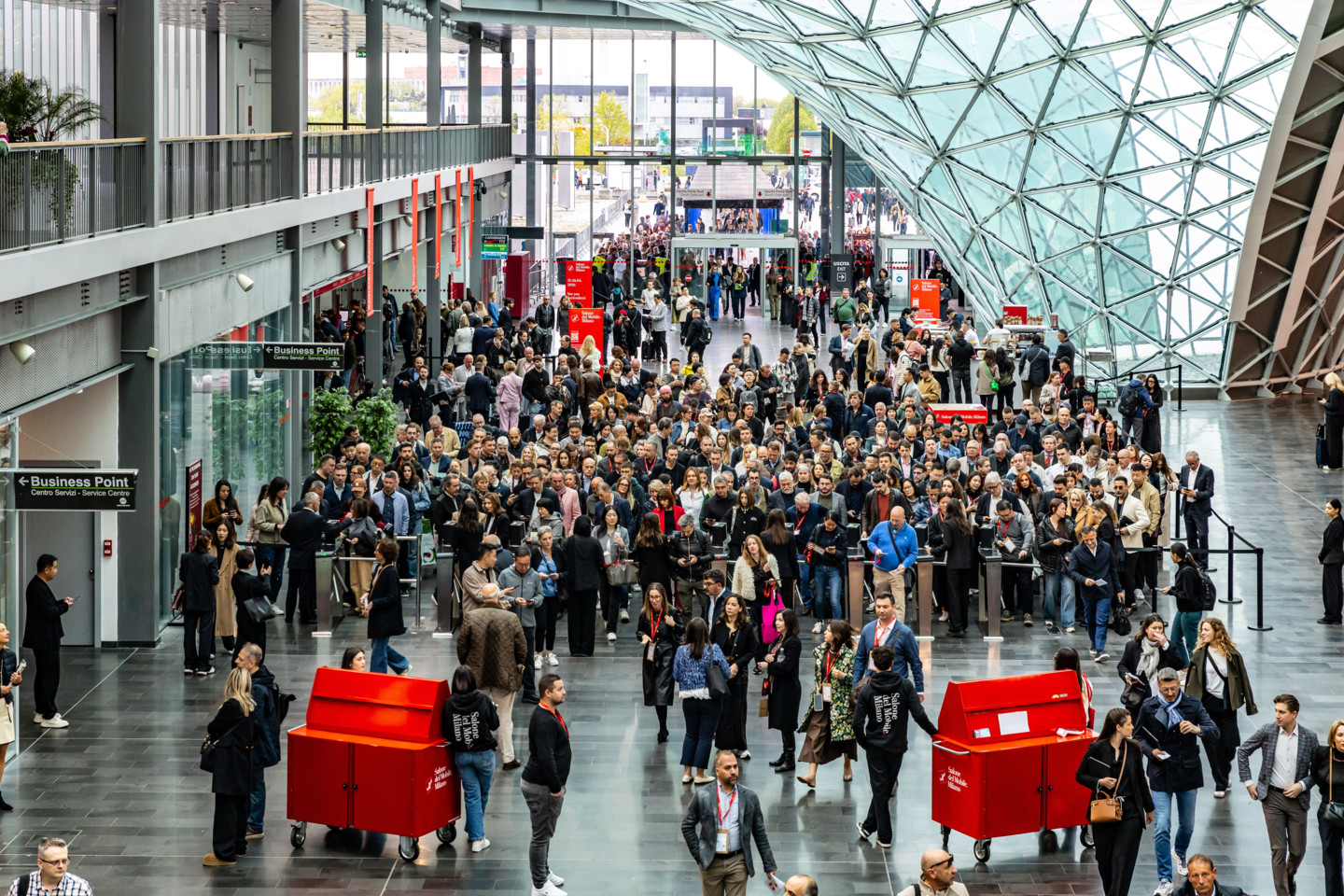

Everything is ready for the big event scheduled from April 21 to 26 with 1,900 exhibitors. Despite the critical issues, the Italian wood-furniture supply chain closed 2025 on a positive note (+1.3%)

February 2026

The countdown is on for the 64th edition of Salone del Mobile.Milano (April 21-26, Fiera Milano, Rho): more than 1,900 exhibitors (36.6% from abroad), 227 brands between debuts and returns, over 169,000 square meters of net exhibition space completely sold out. At the center of it all is the eagerly awaited return of the Biennials: EuroCucina with FTK – Technology For the Kitchen, featuring 106 brands from 17 countries, and the International Bathroom Exhibition, which will bring together 163 brands from 14 countries. Completing the picture is SaloneSatellite with 700 designers under 35 and 23 international schools and universities. Accompanying this is an endless list of events for the Fuorisalone, which will involve a myriad of locations scattered throughout the city, which is preparing to welcome 300,000 visitors.

“In the midst of a geopolitical and economic phase marked by profound discontinuity and new polarities,” commented President Maria Porro at the press conference, “the Salone del Mobile reaffirms its role as a global strategic platform and responds to the markets with vision and continuity, presenting itself as a fixed point in an unstable time: a place where industry meets, thought is articulated, and the future is planned. The sold-out exhibition space and significant increase in foreign attendance are the tangible results of an integrated and forward-looking strategy developed over time.

Contrary to all predictions, the Italian wood-furniture supply chain closed 2025 on a positive note, recording 1.3% growth over 2024 with a turnover of €52.2 billion. This is the picture painted by the preliminary figures compiled by the FederlegnoArredo Research Center and presented at the press conference launching the 2026 Salone del Mobile in Milan. Contributing to this somewhat unexpected result – given the complex global macroeconomic situation – is the performance of the domestic market, which grew by 1.8% to reach €32.9 billion. Exports remained stable (+0.4%), reaching €19.3 billion (37% of the total), despite showing signs of weakness in some strategic markets such as France and the United States. On the other hand, there are some signs of improvement and recovery coming from Germany.

“These figures,” comments Claudio Feltrin, president of FederlegnoArredo, “confirm that our supply chain has been able to implement strategies and actions for adaptation and development that have resulted in substantial stability. We certainly cannot say that we are facing a structural recovery and that we can feel safe from the turbulence that 2026 already has in store for us, but I want to see encouraging signs that we, as a Federation, have a duty to focus on in order to support our companies.”

In 2025, the furniture macro-system will achieve a production turnover of €27.7 billion, essentially stable (+0.6%) compared to 2024. The growth in production for the domestic market (€13.5 billion, +2.1%) offsets the slight decline in exports (€14.2 billion, -0.8%), which continue to account for more than half of the total value. The wood macro-system (including the wood trade) grew by 2%, reaching a turnover of €24.5 billion. However, this figure is partly determined by price trends and a recovery in exports (€5.2 billion, +3.8%). The domestic market (€19.3 billion) recorded +1.5%.

“As regards foreign markets,” adds President Feltrin, “our Research Center’s data updated to October 2025 shows an overall trend of substantial stability, with an estimated value of €19.3 billion (+0.4%), confirming the strategic importance of exports on the sector’s results. Of particular interest in the top 10 is Germany, which returned to positive growth in the first ten months of 2025 (€1.7 billion; +1%), while France continued to show weakness (€2.5 billion; -1.3%), slowing down despite a slight recovery in recent months after two years of strong expansion in 2021-2022. The United States recorded a -2.5% (1.7 billion) decline after the rebound in 2024, with monthly performance influenced by the anticipation of purchases in the spring months in view of tariffs; This was reabsorbed in July (when the cumulative percentage change was still positive at +0.3%), while in the following months exports slowed sharply, particularly in August and October.

On the other hand, positive trends are emerging in some European and non-European markets, which are helping to partially offset the decline in traditional destinations. Among the countries with the best performance in terms of increase in export value are the United Kingdom (+4.2%), the Netherlands (+8.5%), and Spain (+2.3%), which ranks fifth in the Top 10 destination markets, surpassing Switzerland. Markets such as the United Arab Emirates (+3.9%) are also growing, confirming a gradual geographical diversification of foreign sales.

Meanwhile, China continues to advance, gaining market share in both Italy and Europe. “Just think,” Feltrin points out, “that as far as the furniture macro-system is concerned, after strong growth in the second half of 2024, the first ten months of 2025 confirm the trend: +3.7% in Europe, -0.3% in Italy. On the other hand, total imports fell by 7.7%, to the benefit of China, which is gradually strengthening its competitive position in the European market, in a context of growing pressure on Italian exports.”

The highlight of the offering presented at the Chennai trade fair will be the “local for local” range of synthetic tannins with extremely low bisphenol content.

Keep reading...

The leather chemicals company aims to lead the evolution of the wet end process

Keep reading...

The new project by the Tuscan leather chemicals company celebrates boundless creativity

Keep reading...You must login to read this free content

This content requires a subscription to view. Are you already a subscriber? Sign in